Transaction Structure: Core Scientific shareholders will receive 0.1235 shares of CoreWeave Class A stock per share, valuing Core Scientific at approximately $20.40 a share, representing a 66% premium over pre-rumor trading price.

Estimated Closing: Expected by Q4 2025, pending regulatory and shareholder approvals

- Power & Infrastructure: The combined entity adds ~1.3 GW of data center power (with another ~1 GW for expansion), reducing overhead and increasing operational flexibility.

- Cost Savings: Over $10 billion in cumulative lease overhead eliminated over 12 years, plus estimated annual run-rate savings of ~$500 million by end of 2027.

- Vertical Integration: Owning its data centers enables CoreWeave to avoid leasing costs, gain financing flexibility, and reduce fossil expansion risks.

- Michael Intrator (CEO, CoreWeave): “Verticalizing the ownership of Core Scientific’s high-performance data center infrastructure … solidifying our growth trajectory”.

- Adam Sullivan (CEO, Core Scientific): Emphasizes the strong synergy and shared vision to accelerate world-class AI infrastructure.\

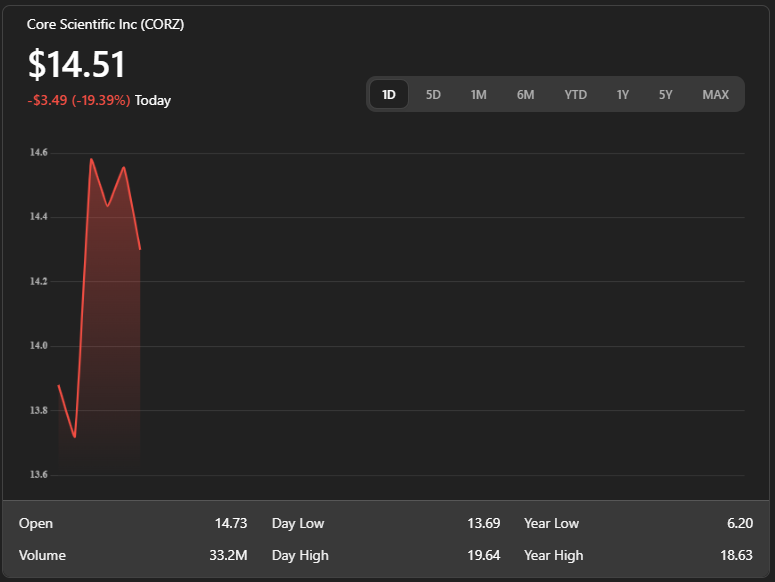

- CoreWeave (CRWV): Shares dropped ~5% pre-market on deal news—investors maybe wary of share dilution.

- Core Scientific (CORZ): Shares surged 33% on rumors previously, but fell over 20% upon deal confirmation—possibly reflecting concerns over valuation ceiling.